Abusing Economics

After studying economics for 6 years, which availed me of the merits of free markets, I have circled back to the conclusion that, overall, Democrats will benefit most people in the long run far more than Republicans. I chronicle my observations in this blog.

Learn Econ on Wikipedia|Blog Archive

Tuesday, March 12, 2024

Wednesday, September 29, 2021

Immigration Reduces Demand for the Policies Democrats Want

"There is a large literature that finds more ethnic diversity and birthplace diversity reduces support for welfare policies."

Thursday, July 22, 2021

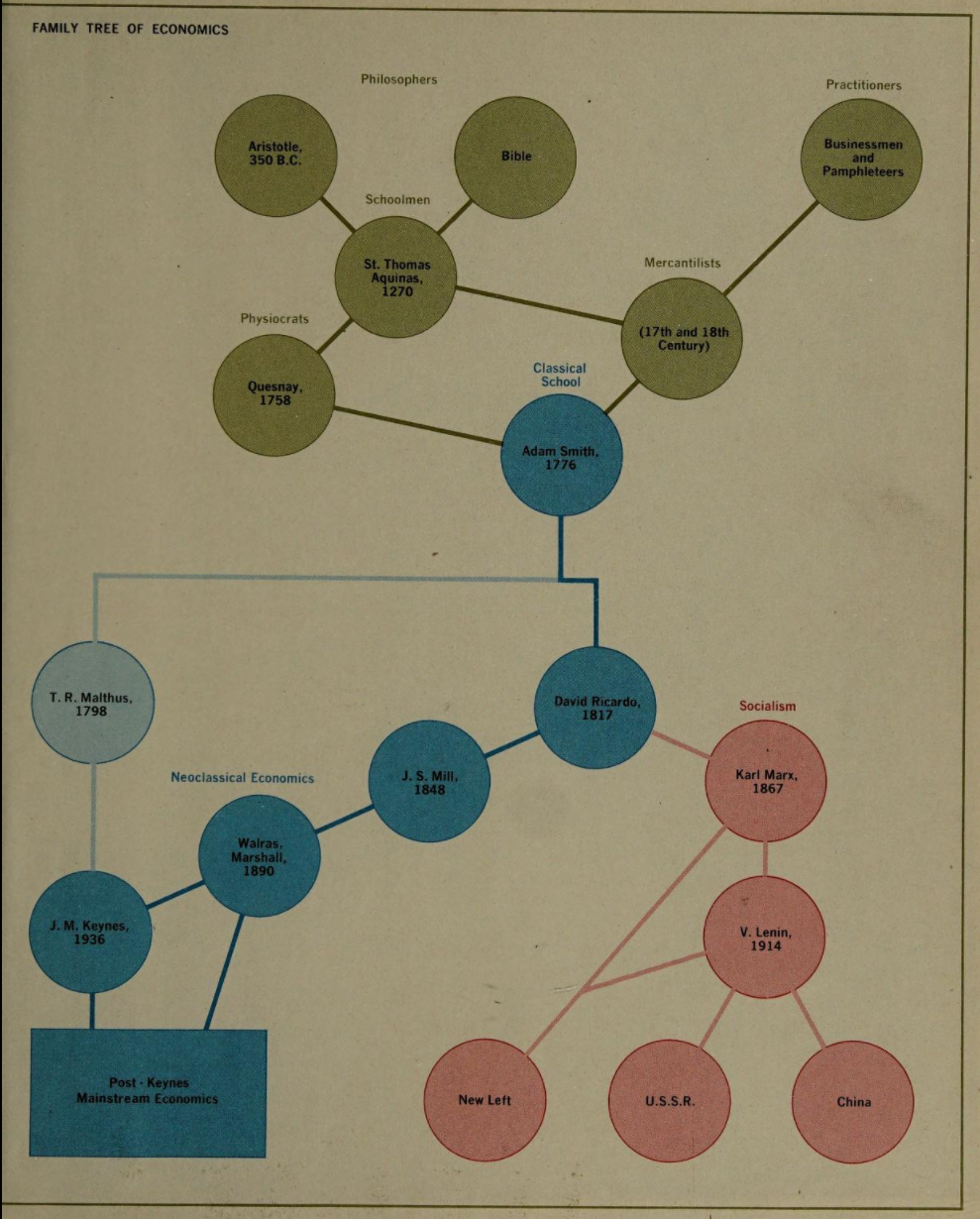

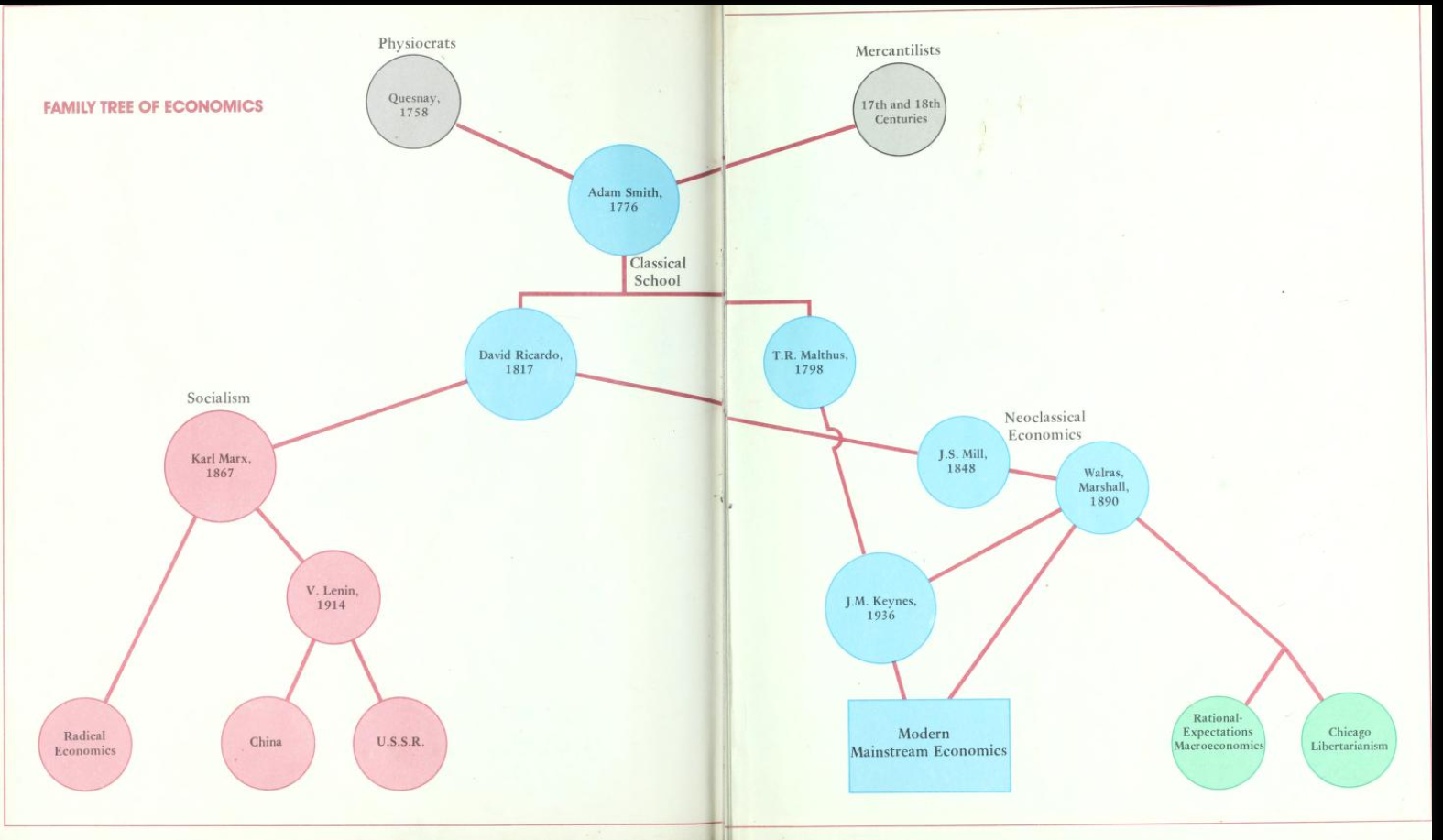

Paul Samuelson's Family Tree of Economics (across editions)

Friday, March 5, 2021

Historic Change for Republicans, complete reversal on Market Fundamentalism

Marco Rubio's speech notes:

PDF link on his site, excerpted below as well.

Video:

https://www.youtube.com/watch?v=imy6cdgTCaU

Excerpt of Speech Notes

●Last month, I spoke to students at Catholic University about the growing sense that our nation’s

institutions, especially in government, are unable to identify a common good and pursue it.

● I outlined my view of how that poses a threat to our economic foundation and our ability to

respond to threats abroad.

● I started the speech using a 19th

-century papal encyclical as its launch point -- a document

written as industrialization was causing tremendous economic change and disruption, a time not

unlike our own.

● This morning I am honored to speak here at the National Defense University to discuss the

defining geopolitical relationship of this century: the one between the United States and China.

● Unfortunately, I was unable to find a papal encyclical on this topic.

● But it is the perfect setting for this message, given the mission of NDU to prepare its graduates

with the ability to develop strategies to solve our nation's most difficult national security

challenges.

Changes in Domestic Attitudes on China

● For decades, we enjoyed a broad consensus that, once China became rich, they would become

more like us -- more democratic and respectful of the rules that govern international trade and

commerce.

● But while China has become richer, it has only deepened its authoritarian grip domestically,

while flagrantly defying international law and commerce.

● The last several years have brought a long overdue and almost too-late readjustment to our views

on China.

● Almost overnight, we have awakened to the reality that “while America slept,” the Chinese

Communist Party has emerged as an immediate and growing threat to prosperity, our freedoms,

and our security.

● Multinational corporations headquartered in our country, in search of quick profits, have

outsourced the dignified jobs that once sustained Americans to China. And our policymakers

rewarded this behavior.

● Now, once vibrant cities and towns are shells of their former selves, where incomes once

supported by a valuable industry get replaced by government checks and credit card debt.

● Tons of fentanyl manufactured in China flood our country, take thousands of lives, and destroy

countless families.

● Experts were intoxicated with post-Cold War fantasies about “the end of history.” A bipartisan

consensus formed that an American-helmed international system would forever be the new

normal, and the arc of all nations was toward democracy and respect for the rule of law.

● We have made great progress toward advancing our values and interests. But it is now clear that

our consensus on China was dangerously flawed.

Explaining the Rise of China

● China believes that its rightful place is at the center of the world and views the last 100 years as

an aberration it intends to correct.

● They have no interest in adhering to the rules of a post-war international system we helped

create, instead seeking to upend or replace it.

● They pursued these plans while “hiding their strength and biding their time,” portraying

themselves as a poor developing country and a non-expansionist power.

● And they succeeded in luring American policymakers into making negligent and catastrophic

mistakes.

● Washington passed financial, trade, tax, and patent laws designed to smooth over the process for

companies to open up operations in China. In turn, China would force those American

companies to partner with domestic competitors, which would steal their trade secrets and then

put them out of business.

● Washington allowed China into what was supposed to be the trade union of free states, the

World Trade Organization. Beijing accepted all the benefits but none of the responsibilities that

came with that membership.

● And under intense lobbying from companies desperate for access to the enormous Chinese

market, Washington did little to call out or address the Chinese Communist Party’s human rights

abuses in Tibet, in Xinjiang, and three decades ago in Tiananmen Square.

● Meanwhile, Chinese leaders kept subsidizing their domestic industries while undermining ours.

● China kept stealing intellectual property and reverse-engineering products.

● China kept expanding access to our markets for their companies, while restricting access to their

markets for ours.

● And China used the profits from these unfair practices to fund substantial investments in research

and development of their own.

● And now we awaken to the reality that for the first time in three decades, we are confronted with

a near-peer rival that seeks to displace us militarily, economically, technologically, and

geopolitically.

● Our aim should not be to halt China’s rise.

● The task before us is to prevent America’s fall.

● China is and will continue to be a great global power, but we must not continue to allow its

progress to come at the expense of our country, our citizens, our values, and the rules-

based international order that emerged from the incredible sacrifices made by the

generations before us – who defeated Nazi Germany in World War II and the Soviet Union

in the Cold War.

● This century will be defined by the relationship between the United States and China.

● And it will either be the story of an unfair and unbalanced relationship that led to the

decline of a once great beacon of liberty and prosperity.

● Or it will be the story of a stable, balanced, and sustainable relationship that allowed us to

further and protect our national interest and the common good of our people.

What Is a Balanced Relationship With China?

● What is that kind of balanced & sustainable relationship?

● It’s to no longer ignore China’s repeated and flagrant violations of the international rule of

law.

● Violations of the assurances they made to the people of Hong Kong when their city was handed

over.

● Violations like the construction and militarization of artificial islands in the South China Sea,

after years of promising the whole world that they would never do so.

● It’s to no longer ignore China’s repeated and flagrant violations of human rights.

● Forcing over one million Uyghur and other Muslims into labor camps in Xinjiang.

● The systematic oppression of all religions: Islam, Buddhism, Christianity, Judaism, and Falun

Gong alike.

● And the crackdown on political dissent at home and freedom of expression everywhere,

including here in the United States.

● It is rejecting Chinese colonial expansionism, which ensnares smaller countries in a state of

permanent economic vassalage.

● The exploitation of political corruption to lay debt traps, bleeding countries dry and then

hijacking their domestic and economic infrastructure.

And the use of state-associated firms like Huawei to entice foreign nations into exploitative

contracts that give China access to foreign nations’ critical national security data.

The Centrality of Economic Power

● But the most important element of a balanced relationship with China is to address how China

has used its material resources, like access to its vast consumer markets, massive labor force, and

technological development of its companies, to further its national interest and undermine ours.

● It is a fact that when you’re doing business with a Chinese company, you’re doing business with

the Chinese Communist Party.

● Beijing has used the foreign investment of American companies to steal intellectual property and

technologies in order to build their own native capacities and destroy ours.

● A few years ago they publicly outlined their plan to dominate ten emerging industries in the 21st

century.

● This isn’t just some tin-pot communist “Five Year Plan.” It is a coherent strategy to become the

world leader in industries such as aerospace, quantum computing, and industrial machinery.

● Let me read to you a quote, one translation of the plan’s introduction:

● “Manufacturing is the main pillar of the national economy, the foundation of the country,

tool of transformation and basis of prosperity. Since the beginning of industrial civilization in

the middle of the 18th century, it has been proven repeatedly by the rise and fall of world

powers that without strong manufacturing, there is no national prosperity.”

● This is a serious and direct challenge our nation must respond to for two reasons.

● First, because one of the most powerful defenses of our American system has long been the

prosperity of our way of life.

● For generations, industrial jobs have made up the core of our middle class, enabling Americans

to make a good living and give their time and treasure back to their families and communities.

These are the families where stable, dignified work allowed kids to “do better” than their parents,

opening up a world of opportunities in education, work, and life.

● In many of our communities, local factories and other industrial centers provided the “good,”

productive jobs -- a source of pride to their communities and envy to much of the world.

● China and its authoritarian communism have aimed to sabotage that defense.

● So while it may be true that China is “breaking the rules” or that Chinese companies are

engaging in “unfair competition” against the American order, the fundamental challenge will not

simply be solved by some future trade agreement.

● The fundamental challenge is that China seeks to prove that you can have a prosperous society, a

contented citizenry, and be the world’s major power without respecting human dignity, freedom,

or God.

● And the second reason we must respond to the challenge before us is because the industries that

China intends to dominate are the very ones that will create the dignified and productive work

Americans need for us to remain a strong nation.

The Perils of Free-Market Fundamentalism

● Responding to this challenge will require us to reject the fundamentalism that argues that the

greatest virtue in American policy is to maximize “efficiency.”

● The market will always reach the most efficient economic outcome, but sometimes the most

efficient outcome is at odds with the common good and the national interest.

● Outsourcing jobs to China may be more efficient because it lowers labor costs and increases

profits.

● But the good jobs we lose end up destroying families and communities.

● Just last year, a study found that areas of the United States that faced Chinese import saturation

from 1990 to 2014 experienced drops in male employment, as well as declining marriage and

fertility rates.

● In communities that bore the brunt of “normalizing” trade relations with China -- to put it

euphemistically -- we even see jumps in suicide rates and deaths from substance abuse.

● For public policy makers, the common good can’t just be about corporate profits. When dignified

work, particularly for men, goes away, so goes the backbone of our culture. Our communities

become blighted and wither away. Families collapse, and fewer people get married. Our nation’s

soul ruptures.

● This experience has become essentialized today in images of decaying Rust Belt towns and the

epidemic of working-class “deaths of despair.” But this story is playing out just as destructively

in our nation’s inner cities – from Flint to Phoenix and Baltimore to Birmingham. The erosion of

dignified work is colorblind and geographically limitless.

● Free enterprise is the greatest mechanism for achieving prosperity.

● However, the market is agnostic as to whether America is a high- or low-wage economy.

● The market is agnostic on whether a certain outcome is in our national interest or the common

good.

● But as a policymaker I am not.

● And I suspect that all of you – men and women committed to our national security – are not

ambivalent either.

● The market may say short-term profits justify adhering to the requirements China places on our

companies.

● But policymakers must take into account that long-term surrendering our productive capacity to

China is reckless.

● The market may say Americans – often unwittingly – should invest in Chinese firms.

● But policymakers must take into account whether American investors should be capitalizing the

very firms that steal from our companies, commit human rights violations, and develop the

weapons that could one day kill the men and women of our military.

● This isn’t a call to socialism or a rejection of capitalism; it’s a call to policymakers to remember

that the national interest, not economic growth, is our central obligation.

● This isn’t a call to recreate the economy of America’s past. It’s a call to invest and compete in

the emerging industries of the future, rather than forfeit them to China.

● And this isn’t a call to kneejerk protectionism. It’s a call to maintain the technological and

industrial superiority necessary to defend our interests and ensure that working Americans have

access to dignified and productive work.

Revitalizing American Industrial Policy

● The critics of this approach argue that I am asking us to choose industries to favor and pick

winners and losers.

● But the truth is we are already doing that. The only difference is the path we are on now is

allowing Beijing to do the picking and the choosing.

● How secure or prosperous can America be if we cannot carry out heavy industry, pharmaceutical

manufacturing, and advanced technology?

● American policymakers must pursue policies that make our economy more productive by

identifying the critical value of specific industrial sectors and spurring investment in them.

● The depletion of America’s manufacturing sector has left us with a tremendous national security

vulnerability.

● I am not advocating for a government takeover of our means of production.

● What I am calling for us to do is remember that from World War II to the Space Race and

beyond, a capitalist America has always relied on public-private collaboration to further our

national security.

● And from the internet to GPS, many of the innovations that have made America a technological

superpower originated from national defense-oriented, public-private partnerships.

● This kind of collaboration is not a rejection of capitalism. It is a call to encourage and harness the

dynamism of our economy’s most productive private industries to further our national security

and ultimately our national economic development.

● It is a call for a 21st

-century pro-American industrial policy.

● When it comes to Chinese firms, our companies aren’t competing with private enterprises; they

are competing with a large and powerful nation-state.

● And in the long run it is a competition that market fundamentalists won’t win.

● Because China has learned how to leverage access to short-term profits as a way to get many

American companies to commit long-term corporate suicide.

● And because China provides their domestic companies the ability to make investments that make

no market sense in the short term but are critical to their national and economic security in the

long term.

● The market fundamentalists argue that government should not be picking which industries to

support -- that instead we should unleash the market to make those decisions.

● But what happens when an industry is critical to our national interest, yet the market determines

it is more efficient for China to dominate it?

● The best example of this is rare-earth minerals, which are vital to our defense and technology

industry.

● America currently imports 80 percent of rare-earths from China because the market has

determined that importing them is more efficient than investing in our own domestic mining

capacity.

● What is in our national interest? To adhere to the market’s determination and be vulnerable to

China crippling our industries and defenses? Or deciding that in this case the threat to our

security makes clear the market is not promoting the common good and, therefore, providing

government support for increasing our domestic capacity to mine rare-earth minerals?

● But the decision to observe when the market advances the common good shouldn’t just be

limited to those instances in which its determination runs contrary to our national defense.

● The most controversial argument I have made is that the loss of productive, dignified jobs for

Americans represents an existential threat to the common good -- especially ones that are not

easily replaced.

● Is it not in our national interest to have productive and dignified jobs available for young people

entering our workforce? For parents who need to support the next generation of Americans? For

veterans returning to civilian life after serving our country?

● Is it not in our national interest to ensure that productive new jobs are not only available to Wall

Street and Silicon Valley but to working Americans across all of our nation?

● This is what motivates me as chairman of the Small Business Committee to overhaul our Small

Business Administration.

● Not because I believe a revitalized SBA alone is the key to creating these kinds of jobs. But

because I believe our federal policies should be directed toward encouraging physical investment

and new, dignified work opportunities here in America.

● I want to ramp up the amount of federal funding for R&D available to small businesses.

● I want to modernize existing SBA programs so they prioritize encouraging investment in high-

potential firms in strategically important industries such as aerospace, rail, electronics,

telecommunications, and agricultural machinery.

● In essence, in the same industries China is trying to dominate via their Made in China 2025

initiative.

● This is just a small part of the much broader modernization of our economic policies that we

need.

● Furthermore, we should expand and make permanent the immediate write-off for any business

investment in machinery, structures, and land, as well as remove bias in our tax code that

incentivizes businesses to buy back shares, instead of reinvesting profits into their firms and

workers.

● We should continue President Trump’s regulatory rollback to achieve a better balance between

our nation’s economic vitality and commonsense protections.

● Doing so will provide a viable alternative for American companies considering joint ventures

with Chinese firms in order to gain access to capital.

● It will help revitalize American manufacturing, which in turn will bring higher wages and stable

work opportunities that allow for renewed family and community engagement. We will

reestablish a capitalism of the common good.

● In an essay last month, NDU professor Walter Hudson invoked the words of President

Eisenhower – an alumnus and the namesake, of course, of your school: “Spiritual force

multiplied by economic force multiplied by military force is roughly equivalent to security. If

any one of those factors fell to zero, or nearly so, the resulting product does likewise.”

● For the United States to be strong in all of these areas, and provide for our long-term national

prosperity, and for a strong national defense, and for the dignified work that allows families and

communities to thrive and share a sense of purpose – we need to restore our commitment to that

kind of common-good capitalism.

Conclusion

● Our current economic policy debate offers us an archaic and false choice.

● The left wants more government programs and more taxes on everything and everyone to pay for

them -- often advocating incentives and punishments on private industry that stoke identity

politics and culture wars, but ignore and even undermine our national security and job creation.

● The market fundamentalists on the right want more record-setting days in the stock market above

all else -- even if it means our dependence on and losses to China continue expanding to

American industries higher up the value chain.

● It is this financialization of economic policymaking that first allowed China to take over the

production of toys, cabinets, and mass consumer electronics -- and then take over the production

of generic pharmaceuticals. And now, they move to take over our genomic therapy industry.

● To what end?

● Until it doesn’t matter what innovation we come up with, because China will steal it and make it

cheaper?

● Until it doesn’t matter how much we spend on research and development, because we need

China to manufacture the end result for us?

● Until every leading technology, communication, transportation, and aerospace leader in the

world is a Chinese state-backed firm?

● If that day should ever come, then we will live in a world in which the most powerful nation on

Earth will not be one that believes all people are created equal and born with a God-given right

to life, liberty, and the pursuit of happiness.

● The most powerful nation on Earth will be a dictatorship that believes man exists to serve the

state; that its citizens’ opinions and religion must be cleared by political leaders first; and that the

only rights you have are those that the government allows us to have.

● What kind of world would that be? What would it mean for Americans here at home?

● We can already see a preview of it in our current events.

● How dozens of Muslim nations defend China’s treatment of Uyghur Muslims for fear of losing

access to the Chinese market or investment.

● How Hollywood self-censors movies and television shows for fear of not being able to make

money in China.

● How the most downloaded social media app in the United States, owned by a Chinese firm,

banned a young American from the platform because she posted a video drawing attention to the

mass atrocities in Xinjiang.

● How under pressure from China, an hourly employee of Marriott in Omaha, Nebraska was fired

for liking a Twitter post from a Tibetan separatist group.

● How nations throughout the world, despite knowing the espionage risk posed by Chinese

telecommunications companies, have allowed them to take over their domestic deployment of

5G, because no non-Chinese, cost-effective competitor exists.

● And how these same companies are so deeply embedded in our own domestic networks that we

still aren’t able to remove their equipment from our own military bases.

● This is but a small preview of the future that awaits us if do not undertake a complete

reorientation of our economic policies.

● It is not enough to ban Chinese technology or condemn Chinese human rights abuses.

● Achieving a peaceful, sustainable balance between the United States and China will require us to

increase our national strength.

● By rejuvenating our nation’s economic power.

● By prioritizing and incentivizing private economic activities that give Americans opportunities

for dignified work.

● And by furthering our national development through 21st

-century American industrial policy

compatible with and complementary to our free market system.

● The stakes could not be higher.

● Because the outcome will define the 21st century.

Monday, January 13, 2020

Thoughts on Our Possible Future Without Work

There's a new book called A World Without Work by economics scholar/former government policy adviser Daniel Susskind. The Guardian succinctly summarizes its prognostications for the future:

It used to be argued that workers who lost their low-skilled jobs should retrain for more challenging roles, but what happens when the robots, or drones, or driverless cars, come for those as well? Predictions vary but up to half of jobs are at least partially vulnerable to AI, from truck-driving, retail and warehouse work to medicine, law and accountancy. That's why the former US treasury secretary Larry Summers confessed in 2013 that he used to think "the Luddites were wrong, and the believers in technology and technological progress were right. I'm not so completely certain now." That same year, the economist and Keynes biographer Robert Skidelsky wrote that fears of technological unemployment were not so much wrong as premature: "Sooner or later, we will run out of jobs." Yet Skidelsky, like Keynes, saw this as an opportunity. If the doomsayers are to be finally proven right, then why not the utopians, too...?

The work ethic, [Susskind] says, is a modern religion that purports to be the only source of meaning and purpose. "What do you do for a living?" is for many people the first question they ask when meeting a stranger, and there is no entity more beloved of politicians than the "hard-working family". Yet faced with precarious, unfulfilling jobs and stagnant wages, many are losing faith in the gospel of work. In a 2015 YouGov survey, 37% of UK workers said their jobs made no meaningful contribution. Susskind wonders in the final pages "whether the academics and commentators who write fearfully about a world with less work are just mistakenly projecting the personal enjoyment they take from their jobs on to the experience of everyone else".

That deserves to be more than an afterthought. The challenge of a world without work isn't just economic but political and psychological... [I]s relying on work to provide self-worth and social status an inevitable human truth or the relatively recent product of a puritan work ethic? Keynes regretted that the possibility of an "age of leisure and abundance" was freighted with dread: "For we have been trained too long to strive and not to enjoy." The state, Susskind concedes with ambivalence, will need to smooth the transition. Moving beyond the "Age of Labour" will require something like a universal basic income (he prefers a more selective conditional basic income), funded by taxes on capital to share the proceeds of technological prosperity. The available work will also need to be more evenly distributed. After decades of a 40-hour week, the recent Labour manifesto, influenced by Skidelsky, promised 32 hours by 2030. And that's the relatively easy part.

Moving society's centre of gravity away from waged labour will require visionary "leisure policies" on every level, from urban planning to education, and a revolution in thinking. "We will be forced to consider what it really means to live a meaningful life," Susskind writes, implying that this is above his pay grade.

The review concludes that "if AI really does to employment what previous technologies did not, radical change can't be postponed indefinitely.

"It may well be utopia or bust."

Sunday, April 1, 2018

Inflation Benefits the Borrower

from https://www.nytimes.com/2018/02/23/us/politics/federal-reserve-interest-rate-increase.html

As Economy Grows, Federal Reserve Frets Next Downturn